New RBI Circular Requires Action: Stay Compliant with EnGRC

The Reserve Bank of India (RBI) issued a new circular on January 31st, 2024, emphasizing the importance of technology-driven solutions for effective compliance management. The deadline for compliance is June 30th, 2024.

This blog post explores the four key requirements outlined in the circular and how EnGRC, a comprehensive GRC (Governance, Risk, and Compliance) platform, can help your organization achieve them effortlessly.

RBI’s Four Requirements: EnGRC Delivers

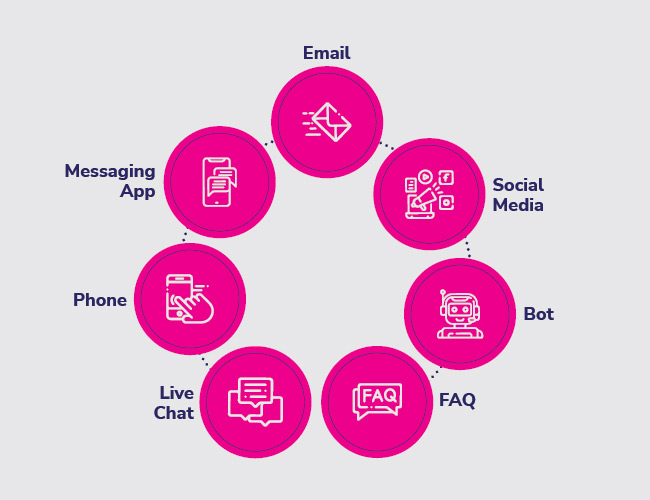

1. Enhanced Communication and Collaboration: EnGRC fosters seamless communication between all stakeholders on a centralized platform. Share documents, guidance, and assign tasks securely. This promotes collaboration and streamlines both risk mitigation and opportunity identification.

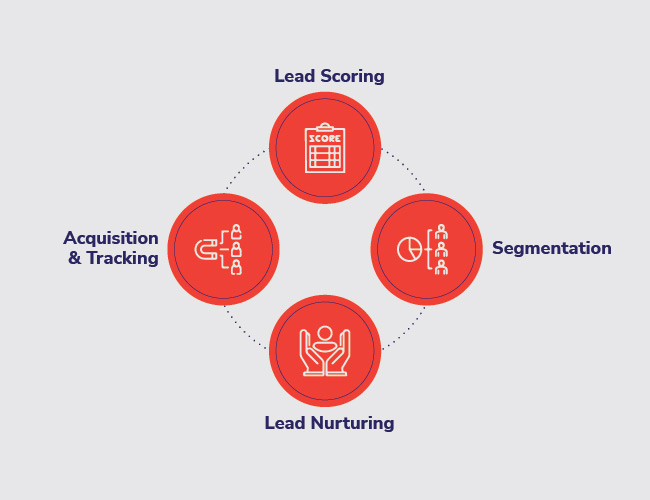

2. Efficient Compliance Management: EnGRC simplifies compliance tracking. Its intuitive interface allows for effortless identification, assessment, allocation, execution, and monitoring of risks and controls. Generate reports quickly and easily to stay on top of progress.

3. Escalation and Approval Management: With EnGRC, identify and track compliance exceptions during audits. Establish automated workflows to assign actions and monitor progress. Email alerts and message boards with relevant guidance keep everyone informed and ensure timely resolutions.

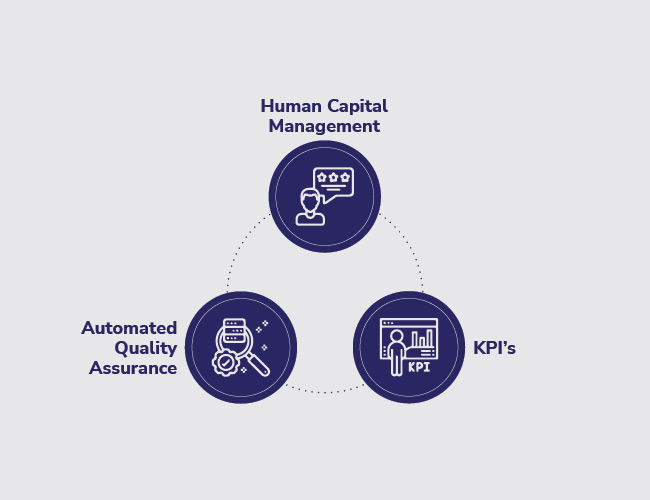

4. Unified Compliance Dashboard for Senior Management: EnGRC dashboards provide real-time insights into your organization’s overall compliance posture. Monitor KPIs and KRIs (Key Performance Indicators and Key Risk Indicators) to identify areas requiring attention. Utilize actionable reports to initiate necessary controls or audits and continuously improve your compliance program.

EnGRC: Your One-Stop Solution for RBI Compliance

EnGRC goes beyond just meeting the basic requirements. Here’s what sets it apart:

- Automated Workflows: Ensure timely escalations, approvals, and task completion.

- Inbuilt Guidance: Improve accuracy and alignment across all GRC activities.

- Actionable Reports and Dashboards: Provide clear visibility to management and stakeholders.

- Progress Tracking: Monitor compliance and remediation activities effectively.

- Interactive Risk Heat Maps: Gain real-time insights for informed decision-making.

- Communication Tools: Email reminders and message boards keep everyone informed.

- Centralized Document Management: Securely store and share documents with audit trails.

- Future-Proof Technology: Leverages Blockchain, ML, AI, and advanced analytics.

Benefits of a Strong Compliance Posture

Maintaining a compliant regulatory posture offers significant advantages:

- Safeguards reputation and brand value.

- Protects customer data and interests.

- Reduces legal liabilities for senior management.

- Enhances data security and operational risk management.

- Minimizes fines and lawsuits due to non-compliance.

- Strengthens business continuity by mitigating downtime and revenue loss.

- Promotes a safer and more efficient work environment.

- Increases customer trust and overall business value.

Responding to Regulatory Change: Be Future-Ready

A robust regulatory compliance strategy with EnGRC keeps you ahead of the curve. Our modular, scalable, and configurable solution equips you with the tools and strategies to proactively manage regulatory changes. Implement compliance initiatives efficiently across your organization and mitigate risks effectively.

Don’t wait until the deadline! Contact us today to learn how EnGRC can help your organization achieve and maintain RBI compliance.

Nilesh Gupta

Nilesh Gupta

Ramu Bodathulla

Ramu Bodathulla Mr. Raj Kumar Ahuja

Mr. Raj Kumar Ahuja Dr. Madan Bhalchandra Gosavi (B.A. (Hons.), LLM, M.Phil, PhD)

Dr. Madan Bhalchandra Gosavi (B.A. (Hons.), LLM, M.Phil, PhD) Mr. Umesh Mehta

Mr. Umesh Mehta Harish Shenoy

Harish Shenoy CA Uttam Prakash Agarwal

CA Uttam Prakash Agarwal Uttam Jhunjhunwala

Uttam Jhunjhunwala Ranjit Balakrishnan

Ranjit Balakrishnan Emmanuel N

Emmanuel N

Rangapriya Goutham

Rangapriya Goutham Kiran Chittar

Kiran Chittar Sushant Purushan

Sushant Purushan Mohan TS

Mohan TS Sanjay Rawa

Sanjay Rawa Dr. Aruna Sharma

Dr. Aruna Sharma Mr.Avtar Singh Monga

Mr.Avtar Singh Monga Mr. Thompson P. Gnanam

Mr. Thompson P. Gnanam Ms. Zohra Chatterji

Ms. Zohra Chatterji Dr. Kalyan Krishnamoorthy

Dr. Kalyan Krishnamoorthy

Mr. Pravir Vohra

Mr. Pravir Vohra Viraf Sirvala

Viraf Sirvala

Amrita Gangotra

Amrita Gangotra